Advance-fee scam

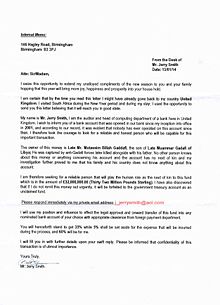

An advance-fee scam is a form of fraud. It is one of the most common types of confidence tricks. Usually, the scam works by telling people that they will get a lot of money. People might be told that they have won in a lottery. The scammers then tell the people that to get this large sum of money, they need to pay a small fee.[1][2] When the payment is made, the scheme repeats or the fraudster simply disappears.[3][4]

The Federal Bureau of Investigation (FBI) states that "An advance fee scheme occurs when the victim pays money to someone in anticipation of receiving something of greater value (...) and then receives little or nothing in return."[3] There are many variations of this type of scam. One example is the Nigerian prince scam, also known as a 419 scam. The number "419" refers to the section of the Nigerian Criminal Code dealing with fraud and the charges and penalties for such offenders.[5] The scam has been used with fax and traditional mail; today it is mainly done in online communications such as emails.[6] Other variations include the Spanish Prisoner scam and the black money scam.

Although Nigeria is most often the nation referred to in these scams, they mainly start elsewhere. Other nations known to have many advance-fee frauds include Ivory Coast,[7] Togo,[8] South Africa,[9] the Netherlands,[10] Spain,[11] and Jamaica.[12][13]

History

changeThe modern scam is similar to the Spanish Prisoner scam that dates back to the late 18th century.[14] The story of that scam was that someone contacted a businessman. That person said that a person who was connected to a wealthy family was imprisoned in Spain. The person would smuggle the prisoner out of the country. For helping, the prisoner agreed to share money with the victim in exchange for a small amount of money to bribe prison guards.[15]

Another variant of the scam dates to the 18th or 19th century: There was a very similar letter, entitled "The Letter from Jerusalem". This is illustrated in the memoirs of Eugène François Vidocq, a former French criminal and private investigator.[16] Yet another variant of the scam, dating back to about 1830, looks very similar to emails today: "Sir, you will doubtlessly be astonished to be receiving a letter from a person unknown to you, who is about to ask a favour from you...". The letter goes on to talk of a casket containing 16,000 francs in gold and the diamonds of a late marquess.[17]

The modern-day transnational scam can be traced back to Germany in 1922.[18] It became popular during the 1980s. There are many variants of the template letter. One of these, sent via postal mail, was addressed to a woman's husband to ask about his health. It also asked what to do with profits from a $24.6 million investment and ended with a telephone number.[19]

Other official-looking letters were sent from a writer who said he was a director of the state-owned Nigerian National Petroleum Corporation. He said he wanted to transfer $20 million to the recipient's bank account—money that was budgeted but was never spent. In exchange for transferring the funds out of Nigeria, the recipient would keep 30% of the total. To get the process started, the scammer asked for a few sheets of the company's letterhead, bank account numbers, and other personal information.[20][21] Yet other variants have involved mention of a Nigerian prince or other member of a royal family seeking to transfer large sums of money out of the country—thus, these scams are sometimes called "Nigerian Prince emails".[22][23]

The spread of e-mail and email harvesting software significantly lowered the cost of sending scam letters by using the Internet instead of international post.[24][25] Nigeria is most often the nation referred to in these scams, they may originate in other nations as well.[26] For example, in 2007, the head of the Economic and Financial Crimes Commission stated that scam emails more frequently originated in African countries or in Eastern Europe.[27] Within the European Union, there is a high incidence of advance-fee fraud in the Netherlands[10] and Spain.[11]

The emails always contain many implausible claims. Very often, they also have a large number of spelling and grammatical mistakes. According to Cormac Herley, a Microsoft researcher, "By sending an email that repels all but the most gullible, the scammer gets the most promising marks to self-select."[28] Responding to Herley, a director at Nigeria's National Security Adviser said that there are more non-Nigerian scammers claiming to be Nigerian He suggested that Nigeria's reputation for corruption is part of the allure that makes scams seem more plausible.[29] Nigeria has a reputation for being at the center of email scammers.[30][31]

Modern variations include “sugar daddy/sugar momma” schemes, some of which involve advance-fee scamming,[32] and money flipping, whereby the mark is promised a large amount of money in exchange for sending a small amount of money.[33]

A 2018 study of Nigerian hip-hop culture found that glamorization of cyber-fraud is prevalent in such music.[34] Some scammers have accomplices in the United States and abroad who move in to finish the deal once the initial contact has been made.[35]

Motives

changeMany scammers come from poorer and more-educated backgrounds. Internet access and better education drive people into committing online fraud. These people often cannot afford basic necessities. They are also influenced by social media celebrities and artists who promote scamming as a "cool" trend to quickly gain access to luxury items like sports cars and fashion.[36]

In the case of Nigeria, the rise in scamming cases was due to a boom in cybercafes, a series of economic crashes from the 1980s, and the resulting joblessness among young people in Nigeria.[37][38]

Countermeasures

changeIn recent years, efforts have been made to combat scammers. In 2004, the Nigerian government formed the Economic and Financial Crimes Commission (EFCC) to combat economic and financial crimes, such as advanced-fee fraud.[40] In 2009, Nigeria's EFCC announced that they have adopted smart technology developed by Microsoft to track down fraudulent emails. They hoped to have the service, dubbed "Eagle Claw", running at full capacity to warn a quarter of a million potential victims.[30]

Some individuals participate in a practice known as scam baiting. They act to appear as potential targets and engage the scammers in lengthy dialogue so as to waste the scammer's time and decrease the time they have available for actual victims.[41] Likewise, Artists Against 419, was set-up by volunteers and offers a public database with information on scam websites. They work closely together with APWG to share their data with financial institutions and cybersecurity companies.

Common elements

changeThese scams have a number of common elements:

- Money transfers are irreversible, and ideally untraceable. Money transfer services such as MoneyGram or Western Union are often used. These services do not allow to track who the money was paid to, or to undo the transfer once it is done.

- Communication is anonymous. Fake E-Mail addresses are used. The idea is that the victim has no way to find the real name or address of the scammer.

- Sometimes fraudsters hijack e-mail addresses of other people, which they then use for these scams.

- Sometimes fax messages are sent. These are similarly untraceable, because they can be simulated or a portanble fax machine can be connnected with a mobile phone with a prepaid number. The same is true for SMS messages

Invitation to visit the country

changeSometimes, victims are invited to a country to meet government officials, an associate of the scammer, or the scammer themselves. Some victims who travel are instead held for ransom. Scammers may tell a victim that they do not need a visa or that the scammers will provide one.[42] If the victim does this, the scammers have the power to extort money from the victim.[42]

Sometimes victims are ransomed, kidnapped, or murdered. According to a 1995 U.S. State Department report, over fifteen persons were murdered between 1992 and 1995 in Nigeria after following through on advance-fee frauds.[42] In 1999 Norwegian millionaire Kjetil Moe was lured to South Africa by scammers and was murdered.[43] George Makronalli was lured to South Africa and was killed in 2004.[44]

References

change- ↑ Lazarus, Suleman; Okolorie, Geoffrey U. (2019). "The bifurcation of the Nigerian cybercriminals: Narratives of the Economic and Financial Crimes Commission (EFCC) agents". Telematics and Informatics. 40: 14–26. doi:10.1016/j.tele.2019.04.009.

- ↑ Lazarus, Suleman (2019). "Where is the Money? The Intersectionality of the Spirit World and the Acquisition of Wealth". Religions. 10 (3): 146. doi:10.3390/rel10030146.

- ↑ 3.0 3.1 "Advance Fee Scams". Archived from the original on 2019-11-01. FBI.

- ↑ "advance fee fraud | Definition, Solicitation, & 419 Fraud Definition | Britannica Money". www.britannica.com. Retrieved 2023-11-02.

- ↑ "Nigeria Laws: Part 6: Offences Relating to property and contracts". Nigeria Law. Archived from the original on March 8, 2005. Retrieved June 22, 2012.

- ↑ "advance fee fraud". Encyclopædia Britannica. Archived from the original on 2023-05-27.

- ↑ "West African Advance Fee Scams". United States Department of State. Archived from the original on June 14, 2012. Retrieved June 23, 2012.

- ↑ "Togo: Country Specific Information". United States Department of State. Archived from the original on 2012-07-02. Retrieved June 23, 2012.

- ↑ "Advance Fee Fraud". Hampshire Constabulary. Archived from the original on February 9, 2012. Retrieved June 23, 2012.

- ↑ 10.0 10.1 "Fraud Scheme Information". United States Department of State. Archived from the original on February 13, 2012. Retrieved June 23, 2012.

- ↑ 11.0 11.1 "Advance Fee Fraud". BBA. Archived from the original on June 28, 2012. Retrieved June 23, 2012.

- ↑ Jackman, Tom (February 12, 2019). "William Webster, ex-FBI and CIA director, helps feds nab Jamaican phone scammer". The Washington Post. Retrieved 12 February 2019.

- ↑ Vasciannie, Stephen (14 March 2013). "Jamaica Comes Down Tough on 'Lottery Scams'". Huffington Post. Retrieved 12 February 2019.

- ↑ "An old swindle revived; The "Spanish Prisoner" and Buried Treasure Bait Again Being Offered to Unwary Americans". The New York Times. 20 March 1898. p. 12. Retrieved 2010-07-01.

- ↑ Mikkelson, David (February 1, 2010). "Nigerian Scam". Snopes. Retrieved June 22, 2012.

- ↑ Vidocq, Eugène François (1834). Memoirs of Vidocq: Principal Agent of the French Police until 1827. Baltimore, Maryland: E. L. Carey & A. Hart. p. 58.

- ↑ Harris, Misty (June 21, 2012). "Nigerian email scams royally obvious for good reason, study says". The Province. Archived from the original on January 4, 2019. Retrieved January 4, 2019 – via Canada.com.

- ↑ "Danielson And Putnam News: Danielson". Norwich Bulletin. 16 November 1922. p. 6. Retrieved 2016-05-07.

- ↑ Buse, Uwe (November 7, 2005). "Africa's City of Cyber Gangsters". Der Spiegel. Retrieved June 22, 2012.

- ↑ Lohr, Steve (May 21, 1992). "'Nigerian Scam' Lures Companies". The New York Times. Retrieved June 22, 2012.

- ↑ "International Financial Scams". United States Department of State, Bureau of Consular Affairs. Retrieved 2015-01-12.

- ↑ "The Nigerian Prince: Old Scam, New Twist". Better Business Bureau. Archived from the original on February 26, 2015. Retrieved February 26, 2015.

- ↑ "Get smart on cybersecurity". Mozilla. Retrieved 2016-02-09.

- ↑ Andrews, Robert (August 4, 2006). "Baiters Teach Scammers a Lesson". Wired. Retrieved June 22, 2012.

- ↑ Stancliff, Dave (February 12, 2012). "As It Stands: Why Nigeria became the scam capital of the world". Times-Standard. Archived from the original on 2012-02-16. Retrieved June 22, 2012.

- ↑ Ibrahim, Suleman (December 2016). "Social and contextual taxonomy of cybercrime: Socioeconomic theory of Nigerian cybercriminals". International Journal of Law, Crime and Justice. 47: 44–57. doi:10.1016/j.ijlcj.2016.07.002.

- ↑ Rosenberg, Eric (March 31, 2007). "U.S. Internet fraud at all-time high". San Francisco Chronicle. Retrieved June 22, 2012.

- ↑ Herley, Cormac (2012). "Why do Nigerian Scammers Say They are from Nigeria?" (PDF). Microsoft. Archived (PDF) from the original on 2012-06-22. Retrieved June 23, 2012.

- ↑ "Blatancy and latency". The Economist. June 30, 2012.

- ↑ 30.0 30.1 Staff Writer (October 22, 2009). "Nigeria's anti graft police shuts 800 scam websites". Agence France-Presse. Archived from the original on April 17, 2010. Retrieved June 22, 2012.

- ↑ "Nigeria shuts 800 scam websites". IOL. October 23, 2009.

- ↑ "More 'sugar daddy' and 'sugar baby' sign-ups – and scams". South China Morning Post. 2020-09-02. Retrieved 2021-06-15.

- ↑ "Flipping Money Scams on Social Networks!". www.foolproofme.org. Retrieved 2021-06-15.

- ↑ Lazarus, Suleman (August 2018). "Birds of a Feather Flock Together: The Nigerian Cyber Fraudsters (Yahoo Boys) and Hip Hop Artists". Criminology, Criminal Justice, Law & Society. 19 (2).

- ↑ Dixon, Robyn (October 20, 2005). ""I Will Eat Your Dollars"". Los Angeles Times. Festac. Retrieved June 22, 2012.

- ↑ Clinton, Helen; Abumere, Princess (14 September 2021). "Hushpuppi - the Instagram influencer and international fraudster". BBC News. Retrieved 16 May 2022.

- ↑ Lin, Sharon (18 April 2022). "The Long Shadow of the 'Nigerian Prince' Scam". Wired. Retrieved 16 May 2022.

- ↑ Akinwotu, Emmanuel (14 June 2021). "Young, qualified and barely scraping by – inside Nigeria's economic crisis". The Guardian. Retrieved 16 May 2022.

- ↑ "Firefox Release Notes". Mozilla. Retrieved 14 September 2010.

- ↑ "Economic and Financial Crimes Commission (Establishment) Act of 2004" (PDF). Economic and Financial Crimes Commission (Nigeria). Archived from the original (PDF) on June 28, 2012. Retrieved June 22, 2012.

- ↑ Cheng, Jacqui (May 11, 2009). "Baiting Nigerian scammers for fun (not so much for profit)". Ars Technica. Retrieved June 22, 2012.

- ↑ 42.0 42.1 42.2 United States Department of State (April 1997). "Nigerian Advance Fee Fraud (DEPARTMENT OF STATE PUBLICATION 10465)" (PDF). State Dept. Bureau of International Narcotics and Law Enforcement Affairs. Archived (PDF) from the original on 2019-08-08. Retrieved January 4, 2019.

- ↑ "The 419 Scam, or Why a Nigerian Prince Wants to Give You Two Million Dollars". informit.com. February 8, 2002.

- ↑ Philip de Braun (2004-12-31). "SA cops, Interpol probe murder". News24. Retrieved 2010-11-27.

Artices about the subject

change- Ibrahim, Suleman (2016). "Social and contextual taxonomy of cybercrime: Socioeconomic theory of Nigerian cybercriminals". International Journal of Law, Crime and Justice. 47. Elsevier BV: 44–57. doi:10.1016/j.ijlcj.2016.07.002. ISSN 1756-0616.

- Lazarus, Suleman; Okolorie, Geoffrey U. (2019). "The bifurcation of the Nigerian cybercriminals: Narratives of the Economic and Financial Crimes Commission (EFCC) agents". Telematics and Informatics. 40. Elsevier BV: 14–26. doi:10.1016/j.tele.2019.04.009. ISSN 0736-5853.

- Lazarus, Suleman (2019-02-27). "Where Is the Money? The Intersectionality of the Spirit World and the Acquisition of Wealth". Religions. 10 (3). MDPI AG: 146. doi:10.3390/rel10030146. ISSN 2077-1444.

Other websites

change- US FBI Internet Crime Complaint Center Archived 2020-12-05 at the Wayback Machine

- Canadian Cybercrime

- Europol Cybercrime

- Why do Nigerian Scammers Say They are from Nigeria? by Cormac Herley of Microsoft Research